Sulphur Fuel Regulations Poised to Increase Binder Prices

BY Sandy Lender

Since Jan. 1, 2012, the International Maritime Organization (IMO) members have limited the amount of sulphur content allowed in fuel oil to 3.5 percent by mass (m/m). Starting Jan. 1, 2020, the maximum sulphur content allowed in fuel oil of any ship or vessel operating anywhere in the world will be 0.5 percent m/m. You will hear members of industry refer to this deadline for compliance as MARPOL 2020.

“This new limit aims to reduce the impacts of sulphur oxide (SOx) emissions on the environment and human health, particularly for people living in port cities and coastal communities,” according to the Australian Maritime Safety Authority website. This change in fuel regulation could impact what’s available for refiners to offer the asphalt industry.

Smoke on the Water

Asphalt Operating Services LLC is located in Chicago. Photo courtesy ECF Inc., Columbia, Illinois.

As all technical articles must, we begin with a couple definitions. The Energy Information Administration (EIA) defines “sulfur” as a “yellowish nonmetallic element, sometimes known as ‘brimstone.’ It is present at various levels of concentration in many fossil fuels.”

A variety of references combine to define: petroleum-derived liquid asphalt cement (AC) is a dark brown (or black) cement-like residual from the distillation of a “suitable” crude oil, such as a heavy or sour crude. The distillation processes may involve atmospheric distillation, vacuum distillation, steam distillation, or a combination thereof.

To oversimplify the discussion, remember when refineries distill a barrel of crude oil, the many resulting products represent financial streams for the owner. If the specific crude oil typically offers a low sulphur content in its refined products, that crude oil will be of more value to the owner in the near future. The team at Argus Media report: that will most likely bring a switch to light, sweet crudes.

Ship owners have the option to place specialized filters (scrubbers) on their ships to engineer a solution for reducing sulphur emissions. During the “Americas Bunkers Market Trends and MARPOL 2020 Strategy” webinar hosted by Argus Media in Q1, presenters shared “[t]here’s no appetite among ship owners to invest in scrubbing equipment prior to 2020.” The remedy will be to purchase fuels that offer lower sulphur emissions.

Refiners Will Adapt

Refiners can get your AC to the terminal any number of ways including, as you see in this images, by rail or barge. Photo of terminal courtesy ECF Inc., Columbia, Illinois.

At the National Asphalt Pavement Association (NAPA) annual meeting in San Diego in February, Don Wessel of Poten & Partners Inc., New York, shared with the audience that the maritime rules will make light, sweet crudes of more value to refiners. It’s business.

The team at Argus Media sees this trend coming up as well. During its “Americas Bunkers Market Trends and MARPOL 2020 Strategy” webinar, the presenters discussed what options refiners have to meet low sulphur fuel demand.

“MARPOL 2020 will be disruptive,” they shared. When 85 percent of a marketplace switches to a different fuel, the refiner must switch to a new fuel as well. “They will probably switch to a light, sweet crude,” Argus members reported.

Other options for refiners include cracking, but none of their options put a large portion of the refiners into asphalt-friendly crudes. In the recent past—think 2008, 2009—when prices for liquid AC soared, the tonnage of mix placed in North America decreased. Asphalt plant consultant Tim Sharretts, proprietor of Asphalt Producers Service (APS), Derry, New Hampshire, explained:

“Tonnages went down when prices went up, which caused prices to go higher. It was a vicious cycle. We had a lot of pressure on the suppliers. The refineries went to other products that brought them more money.”

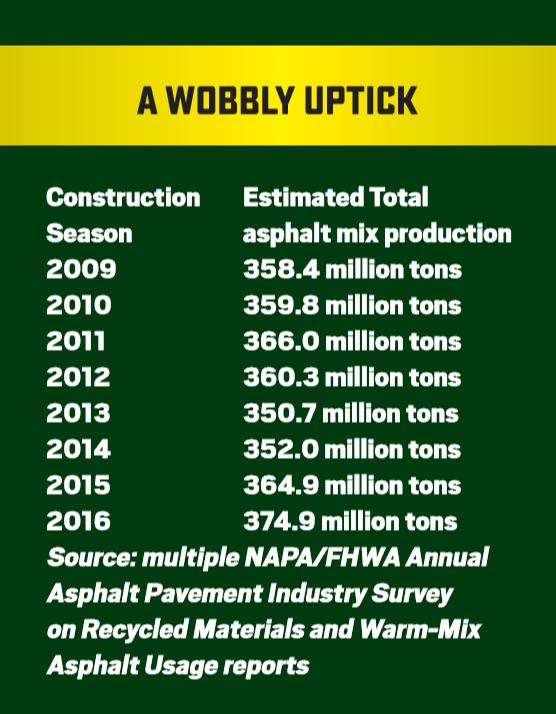

Not all refinery owners felt comfortable switching back to production that results in liquid ACs with the high-quality attributes our industry demands. We’ve gotten picky. Refiners have gotten cautious. Our final mix tonnages have not recovered fully to pre-2008 levels, although we see a wobbly curve in the right direction if you follow the estimated tonnages reported in the Annual Asphalt Pavement Industry Survey on Recycled Materials and Warm-Mix Asphalt Usage produced by NAPA and FHWA (See Table 1).

Monitor Your Tanks

This terminal in California shows quality construction and piping up close. Photo courtesy CEI Enterprises Inc., Albuquerque, New Mexico.

As with any discussion of futures or materials costs, sources don’t want to get into specific amounts or pricing. Rest assured, the asphalt industry will see the usual ebb and flow of liquid binder prices as MARPOL 2020 nears.

At the NAPA annual convention, Wessel shared that the late spring start of 2017 contributed to soft prices last year. Talk to anyone living north of the Mason-Dixon Line and you’ll understand why we saw a late start again in 2018.

Change is part of doing business. One way to protect against uncertainty is to buy low and store for summer use. Savvy producers have been doing this for years, going so far as to install their own terminals to make large capacities possible. If you elect to build additional liquid storage capacity, be smart about it. Insulate everything from pipes to joints to transfer points. Call on an OEM who will help you navigate the steel tank rules and regs, as well as a burner technology expert who will help you meet air quality standards.

Stretch Your Material

Of course, as Sharretts pointed out, there comes a time when you have to refill the tank. The answer he had for producers is to maximize the recycling levels each state will allow. Lennie Loesch of Stansteel, Louisville, Kentucky, reminded producers that using recycle will cut down the liquid you have to buy anywhere from 10 to 30 percent, depending on your source, location, percentage of binder replaced, etc. That can represent a significant savings if the price—or availability—of liquid material becomes problematic.

Of course the asphalt industry is already making use of recycling practices. “Recycle has been embraced,” Sharretts said. “Now we just want to do more.”

The Annual Asphalt Pavement Industry Survey on Recycled Materials and Warm-Mix Asphalt Usage: 2016 Report from NAPA concluded: “The total estimated tons of RAP used in asphalt mixtures reached 76.9 million tons in 2016. This represents a greater than 37 percent increase in the total estimated tons of RAP used in 2009. During the same time frame, total asphalt mixture tonnage increased only 4.6 percent. The average percent RAP used by all sectors has seen variable growth from 2009 to 2016. The year-to-year growth in the average percentage of RAP use has slowed from 2009 to 2016, decreasing from a 1.8 percent increase from 2009 to 2010 to 0.2 percent increase from 2015 to 2016. The average estimated percentage of RAP used in asphalt mixtures has increased from 15.6 percent in 2009 to 20.5 percent in 2016.”

No matter the causal agent, liquid price fluctuations are a part of standard operating procedure for asphalt professionals. With the maritime regulations for sulphur fuel oil looming, asphalt producers can stay one step ahead as far as planning for the next potential disruption by preparing good storage facilities and best recycling practices.