How to Construct an ESOP

BY Scott Eichler

You’ve set up your management team. You’ve built a strong business that generates good income. You’ve gone through the due diligence and now you’re ready to set up an employee stock ownership plan (ESOP). What’s next?

As a refresher, an ESOP is a structure used to sell a business to employees. Often this allows a business owner in the construction industry to maximize the value obtained from the sale of the business. We’re going to walk you through an abridged version of setting up an ESOP.

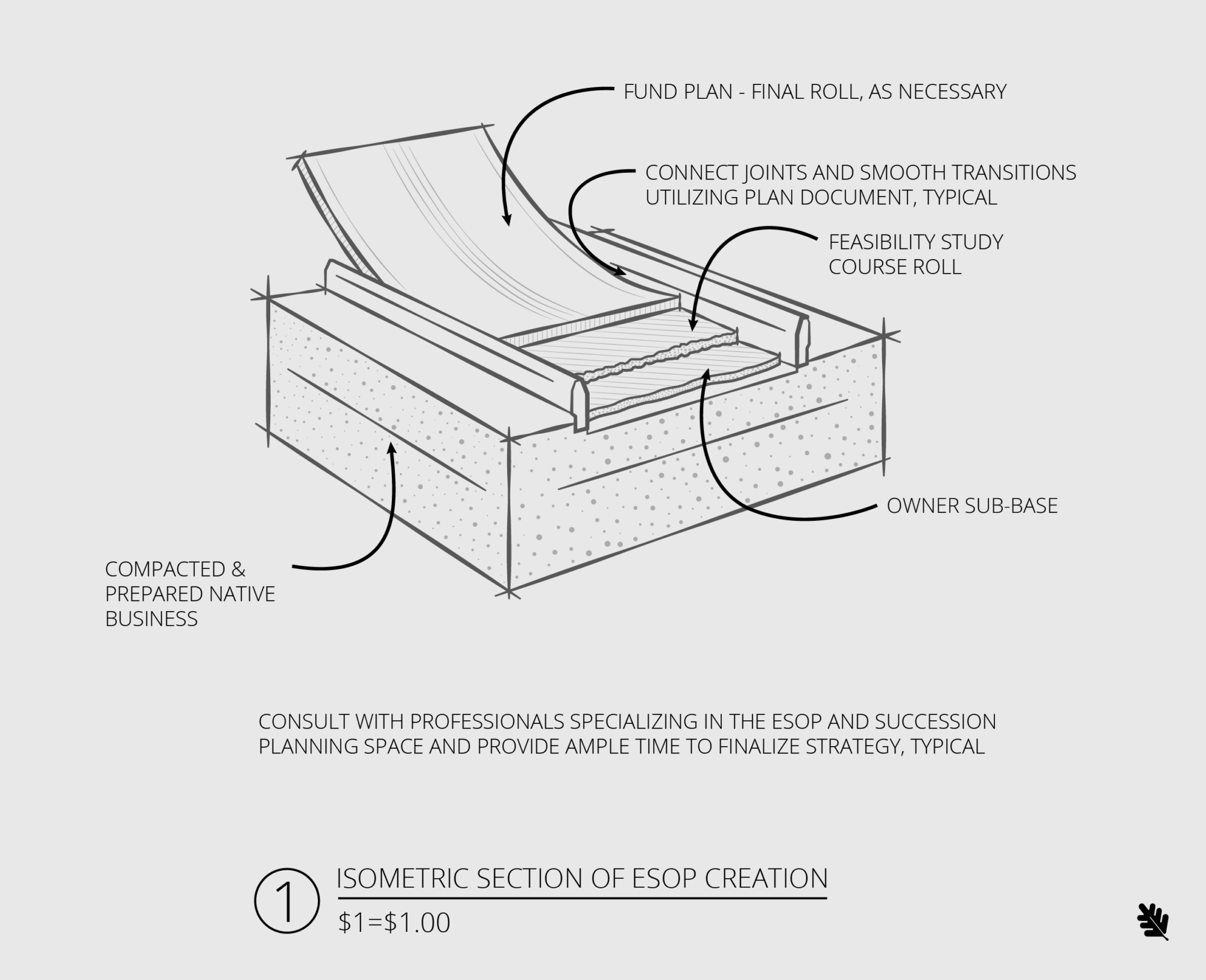

First, we need to assess if all the owners are on board. Don’t take this step for granted. In terms of paving, this is the grading and subbase. If you screw this up, it doesn’t matter how well you perform the next steps. Make sure that all owners are, at a minimum, open to discussion.

Second, create a feasibility study. This is your proof roll. We’re confirming that everything is well laid out and finances are going to support the structure to come. You may want to try and do this in-house, but we would recommend finding an advisory firm that specializes in buyout and merger and acquisition (M&A) strategies. A good firm will be able to compare different types of plans and find a slightly better fit through informed adjustments. Analysis should confirm sufficient cash flow devoted to the ESOP and fulfilling the stated purposes of the ESOP.

Additionally, you’ll need to confirm the company’s payroll is adequate to make ESOP contributions deductible for participants. Finally, the repurchase obligations of the company will need to be estimated.

Third, you’ll need to value the company’s stock. The asphalt connects the substructure (ownership) to the business end of the pavement (the employees). That connection is the value of the company. Everyone needs to agree to a price.

It is critical that you value the company before implementing a plan. You may want to start with a preliminary valuation to see if this route is a non-starter. However, if you go this path, you’ll want a separate appraiser for the detailed valuation. You do not want a regulator raising concerns about objectivity. The reasoning is that a preliminary valuation is done for the current owner of the company and the detailed valuation is done on behalf of the potential ESOP. To that end, the ESOP trustee should select and hire the appraiser for the transaction. A valuation professional will look at cash flow, profits, assets, goodwill, market conditions, values of comparative companies, etc.

Fourth, you can move on to drafting a plan. You’ve laid out everything and now you need to connect all the dots, butt those joints, and smooth out transitions. If you’ve hired a company to help with the process, they should be able to refer you to an attorney. If you’ve done everything in-house, you’ll need to hire an ESOP attorney. You’ll want an attorney for this part. Attorney’s have E&O insurance. If they screw up the document, they are on the hook for damages. This is cheap insurance for a bad document.

Fifth, you’ll need to fund your plan. This is your finish rolling. This can be done through a traditional bank, private parties, or the seller of the business. Additionally, the company could make ongoing contributions or company benefit plans. Most ESOP experts find that temporarily investing outside of company securities is advisable to build up funds to buy out ownership. Employees can also contribute to the plan through wage and/or benefit concessions. Regardless, the funding should match the long-term goals of ownership.

Help Leaders & Employees Handle the Pressures of Construction

Sixth, you must maintain the plan. Just like pavement needs maintenance, an ESOP needs maintenance. And if you do a good job, it won’t need replacement. An ESOP requires oversight, compliance and reporting to maintain its preferential tax treatment. Also, a plan to communicate with employees that are becoming owners is invaluable. This will represent a new chapter for many employees. As we all know, an ounce of prevention is better than a pound of cure. Education and communication is the best way to provide that protection.

Disclosure: Standing Oak Advisors and Centaurus Financial Inc. do not offer tax or legal advice. Scott Eichler is a registered investment advisor and founder of Standing Oak Financial, as well as author of best-selling book “Don’t Play Chicken with Your Nest Egg.”