Claim DBE Supply Participation Correctly

BY Lorraine D'Angelo

General contractors cannot treat all disadvantaged business enterprise (DBE) supplier firms in the same manner. The rules for claiming participation differ depending on whether the firm is used as a subcontractor or subconsultant, material or equipment supplier (regular dealer, manufacturer or broker), or trucker. It is important to recognize which category the firm falls under because the amount of participation that can be claimed for each is different and those differences can be significant when attempting to satisfy the project goals.

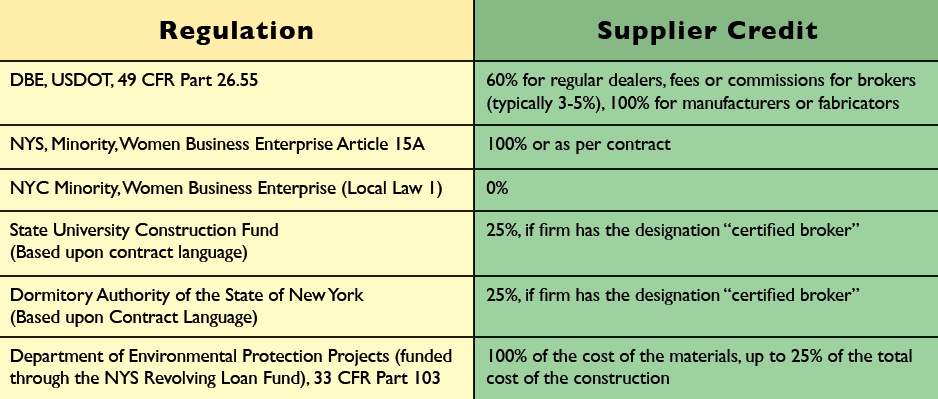

In addition, agency rules complicate claiming credit for suppliers because agencies treat suppliers differently. Depending on which agency you are working for, a contractor may be able to claim 100 percent of the cost of the supplies, 25 percent if the supplier has a “certified broker” designation, only fees and commission, 60 percent under the DBE regulations if it meets the criteria, 0 percent under the NYC Regulations (Local Law 1), etc.

The Federal DBE regulations define a regular dealer as “an established, regular business that engages, as its principal business and under its own name, in the purchase and sale or lease of the supplies or products in question.

Additionally, a regular dealer owns, operates, or maintains a store, warehouse, or other establishment in which the materials, supplies, articles or equipment of the general character described by the specifications and required under the contract are bought, kept in stock, and regularly sold or leased to the public in the usual course of business.”

*Note that the chart is intended as an example. Specific contract provisions or regulations may impact how attainment may be claimed. If you are in doubt, you should seek assistance.

The commentary to the regulation goes on to state: “a firm that supplies a product on an ad hoc basis to a few contractors with whom it has a special relationship, rather than to the general public as a whole, is not a regular dealer.” Packagers, brokers, manufacturers’ representatives, or other persons who arrange or expedite transactions are not regular dealers.

The Federal DBE regulations essentially leave it up to the contractor to determine whether a supply firm is a regular dealer or a broker on a contract-by-contract basis. In my opinion it is really an item-by-item basis, which is a daunting task. The distinction is significant because the amount that can be claimed for participation as a regular dealer is 60 percent of the cost of the materials vs. a broker where the fee/commission, typically 3 to 5 percent, is all that can be claimed. Regular dealers of bulk item supply (e.g., petroleum products, steel, cement, gravel, stone, or asphalt) have different qualifying rules, but limit the participation to 60 percent of the cost of the materials. The State regulation (Executive Law Article 15-A) provides little guidance about how to count suppliers and it can be up to 100 percent of the cost of the supplies but it is dependent upon the contract requirements. For example, the rules for claiming material suppliers on a project funded through the NY State Revolving Loan Fund on an EPA Project can be 100 percent of the cost of the material supply up to 25 percent of the total contract value. The NY City Regulations (Local Law 1) do not permit counting material suppliers in the construction setting. For NYC projects, 0% is permitted to be counted for attainment.

Under any of the applicable regulations, the participating firm must still perform a “commercially useful function” (CUF). If you are using material supply to satisfy a contract goal, it is imperative that you understand the particular rule that applies to your contract (usually dependent upon the source of funding). Assuming a supplier is performing a CUF, the chart attempts to summarize how attainment participation may be claimed for suppliers.

A recent case highlights the importance of getting it right. On Aug. 14, 2015, The USDOT Office of the Inspector General reported that HD Waterworks, Atlanta, described as the “nation’s largest supplier of water, sewer, fire protection and storm drain products” paid $4.9 million dollars to settle civil allegations made under the False Claims Act that it used a DBE as a “pass through.” According to the USDOT-IG, contractors reported that they were using American Indian Builders & Suppliers, a now defunct DBE, for supply. However, it appears, based on invoices, that HD Waterworks was supplying the materials to the contractors, who would then pass its invoices—with a mark-up—through American Indian Builders & Suppliers. This settlement was reported to be the largest of its kind involving a third party supplier in a DBE fraud case.

Lorraine D’Angelo, a nationally-recognized expert on legal and regulatory risk management, is the president of LDA Compliance Consulting, Inc. She has more than 25 years’ experience in the construction industry, including a recent tenure as senior vice president for ethics and compliance at a global construction company. D’Angelo is an accredited ethics and compliance professional and a leading expert on small, women-owned, minority and DBE matters, programs and policy implementation. For more information, contact her at (914)548-6369 or Lorraine@ldacomplianceconsulting.com.

Lorraine D’Angelo, a nationally-recognized expert on legal and regulatory risk management, is the president of LDA Compliance Consulting, Inc. She has more than 25 years’ experience in the construction industry, including a recent tenure as senior vice president for ethics and compliance at a global construction company. D’Angelo is an accredited ethics and compliance professional and a leading expert on small, women-owned, minority and DBE matters, programs and policy implementation. For more information, contact her at (914)548-6369 or Lorraine@ldacomplianceconsulting.com.