Citrus Availability Could Affect D-Limonene Costs

BY AsphaltPro Staff

What does “clean” smell like?

“If you ask your Grandma, she’d probably say bleach. Mom would say Pine Sol, but we usually think of citrus—lemon or orange,” Andy Shafer said. He’s the executive vice president of sales and market development at Elevance Renewable Sciences, Inc., Woodbridge, Illinois.

Citrus ingredients are commonly used in cleaning products used by the paving industry as an alternative to the illegal use of diesel fuel. These ingredients also serve in asphalt solvents and cold-patch products. As simple as it may seem, Americans’ taste for orange juice may be affecting the asphalt industry. Orange juice sales have dropped nearly every year for more than a decade and hit an all-time low last year, according to Nielsen data published by the Florida Department of Citrus.

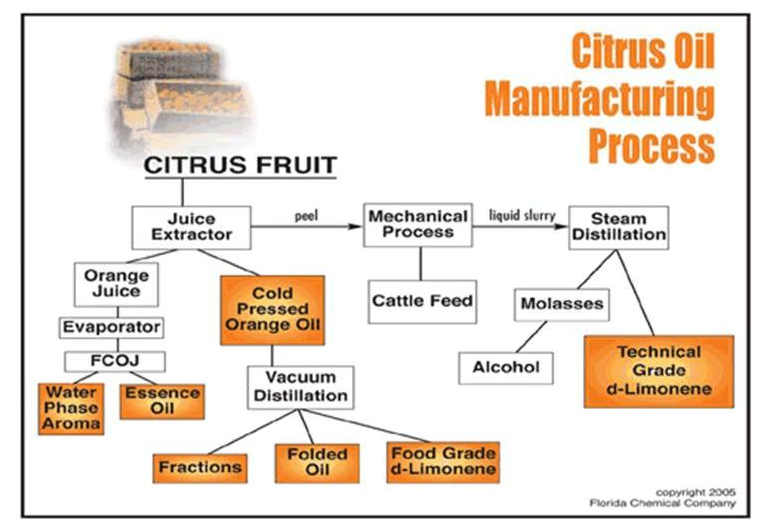

D-limonene, a common solvent and cleaning formulation ingredient, is produced from oils found in orange rinds.

“[Producers] use every bit of the orange,” Shafer said. “They make orange juice and the leftover peel is used to create orange extract and d-limonene.” But producers are reducing the number of orange trees as their land becomes more valuable for other uses.

“Pair that long-term decline with the fact that in the chemical industry, people are trying to move to greener, bio-based solutions like d-limonene and you’ve got short term volatility in the face of long-term trends,” Shafer said. As the industry moves away from chlorinated and hydrocarbon solvents and petrochemicals toward solvents that are “more acceptable from environmental, health and safety standpoint,” Shafer said, volatility could get worse.

Another factor is the rise of citrus greening, also known as Huanglongbing and yellow dragon disease, which was first spotted July 2014 in Brazil, which produces around one third of the world’s orange supply.

According to the Associated Press, Florida’s citrus production has declined by 60 percent since the state’s first case of greening was confirmed in 2005, which correlates with the first time orange prices breached $1,000 per metric ton. The United States is the world’s second largest producer of oranges, at 12 percent of global production, according to 2014 Food and Agriculture Organization statistics.

Market volatility

“Of all the products in our line, d-limonene by far has the most volatile price,” Damon Hudac, marketing coordinator of FBC Chemical, said. FBC Chemical, headquartered in Mars, Pennsylvania, is a full-service independent chemical distributor. “[Market volatility] can play havoc with cost management efforts of blenders and manufacturers that use a significant portion of d-limonene in their ‘citrus cleaners’ or degreasers.”

For example, in 2012, the price of d-limonene reached record highs, at almost $5 per pound, Hudac said. Within months, he said, per-pound prices dropped to $1.50 before increasing once again.

“[D-limonene’s] citrus-based origin explains the historic price volatility, as orange supply is vulnerable to innumerable weather and other natural issues,” Hudac said. “Hurricanes, early or late frosts, excess rainfall, drought, and plagues of locusts have all negatively impacted the orange crop at one time or another.”

Hudac said there’s no surefire solution to protect against d-limonene market fluctuations.

“Whenever a customer tells me that they are considering adding a citrus cleaner to their product line, I explain that d-limonene has some great cleaning and environmental properties,” Hudac said, “and I always caution them to make sure they can handle the roller coaster ride of d-limonene prices.”

FBC Chemical consults with customers who may be having difficulty with the price fluctuations of d-limonene, and Hudac said, has “ample experience in adjusting formulas” to reduce dependence on d-limonene. “We don’t get a lot of requests to remove d-limonene because our customers generally avoid it due to the price volatility, unless they really want the orange oil in there or they use it as a small percentage of their formula.

“This [market volatility] challenges companies like ours to find products that perform better, cost less and allow our customers to make more money,” Shafer said. “Every day I get up and worry about that.”

This past August, Elevance introduced a new cleaning product to help buyers and formulators of d-limonene reduce uncertainty in price and supply, as well as improve performance of d-limonene formulations.

The new Elevance Clean™ 1000 offers formulators an option to use less d-limonene, thus reducing uncertainty in price and supply. The new product boasts a solvency power of 99, compared to d-limonene at 67, and a flashpoint of 215oF, compared to 122 for d-limonene, which reduces flammability, and increases dwell time to 20 minutes.

“We’ve introduced an ingredient that can reduce the impact of supply/demand volatility, improve performance and blend nicely with citrus,” Shafer said. “You get the same aesthetics, better cleaning and better costs.” Rather than use 100 percent d-limonene, the new formula replaced 40 or 50 percent d-limonene.

“Both soy bean and palm oil are produced on an enormous scale globally for food and industrial uses,” Shafer said, so the supply chain is much larger than that of citrus fruits. “We use only a very tiny fraction of that supply chain.”

Use the right stuff

ChemStation International, based in Dayton, Ohio, uses d-limonene as a solvent to remove asphalt from surfaces, and also offers other chemistries for this purpose, including dibastic esters, naturally derived vegetable oil and water-soluble solvents.

“Usually these alternatives are costlier, so we don’t sell as many of them as we might d-limonene or dipentene formulations,” Bruce Phillippi, director of research and manufacturing, said.

Phillippi estimates that about 5 percent of ChemStation’s customers use d-limonene; the rest use a d-limonene alternative. But, he said, d-limonene price fluctuations have been restrained in recent years.

According to the World Bank’s Commodities Glossary, orange prices closed out 1985 at $318 per metric ton. Prices peaked in July 2008 at $1,431.69 and have remained relatively stable between $600 and $800 since July 2014. In August 2015, the price per metric ton was $684.28.

“When margins are affected to the point where delivering product is no longer profitable, we offer the customer alternative chemistries,” he said. Phillippi said alternatives tend to be cheaper than d-limonene, but the final cost of a formulation depends on how much active ingredient is present. “If we can put in less and still remain effective, that is one method of controlling the cost of the derived formulation.”

Regardless of the solution, any formula changes require additional testing on the part of the customer, Phillippi said, “but most are willing to try in order to avoid increased costs.”

During 2008 and 2009, Phillippi said, the price of d-limonene fluctuated significantly, and during the Gulf Oil Spill, it spiked in excess of 400 percent. “Many customers opted out of d-limonene products at that time,” Phillippi said. “Most who opted out haven’t returned.”

Most, he said, are content with the new formulations and don’t see a reason to return to d-limonene products. At that time, many customers switched to dipentene, an alternative to d-limonene.

“The two behave quite similarly, especially in asphalt release formulations,” Phillippi said. Dipentene is an enantiomer of d-limonene; chemically, it’s l-limonene.

“Dipentene does not have the pleasant orange odor of d-limonene, but since it’s derived from pine trees and not yearly orange harvests, the price is much more stable over the long term,” Phillippi said, “and cleaning performance remains consistent.”

AQUA Patch Road Materials, based in El Segundo, California, uses dipentene, which they call tall oil, in their all-natural, environmentally friendly cold-mix product.

“It’s been the big thing to use for a long time,” AQUA Patch Manager Jun Goto said. AQUA Patch’s goal is also to decrease prices with their formula.

“As one of the more popular options,” Goto said, “the price of tall oil is pretty stable.”

Aquaphalt, based in Charlottesville, Virginia, produces a cold patch product using rape seed oil mixed with aggregate.

“We didn’t set out to design an environmentally friendly product, we set out for a permanent asphalt product,” Michael Wertheim, national director of sales said. “It just so happens that the product we came up with is environmentally friendly.”

Mike Milano, sales manager of Greenpatch—a producer of a cold patch product—says they use plant-based softeners with a flashpoint of more than 400oF on the asphalt. Although Milano wouldn’t share the plant variety, he said it is something uncommon but expensive.

Pining for a solution

Chemtek, based in Research Triangle Park, North Carolina, also doesn’t use citrus for their solvent, PavePro, which is comprised of biodegradable, naturally-derived solvents.

Marketing Director Kat Murray said the cost of the primary ingredient in PavePro is much more stable than citrus products, due to its large demand in the cosmetic industry.

“The price stability of citrus-based raw materials derived from citrus processing are a concern,” Murray said. “It’s not unheard of for the price of these raw materials to more than double in a year. Those price swings are often transferred to some degree to the end-use customer.” She said the components of PavePro are readily available on a continuous basis so the price is much more stable.

Chemtek did use citrus in the first iteration of PavePro, more for the scent rather than as a solvent. “But it confused people, who thought it was a citrus product, so we took it out.” Even after removing it from the formula, they offered to add it upon user request.

“As a general philosophy, we do not believe citrus-based raw ingredients provide the best basis for an asphalt cleaner or release agent,” Murray said. “The price fluctuations further deter us from pursuing it as the basis for any new product.”

Citrus Shortage

Oranges aren’t the only citrus fruit on the block experiencing supply shortages. Following the drought in California, lemon prices are up 43 percent, and as a result of import issues in the face of the Mexican Drug War, lime prices are up 400 percent.

Catch and Release

“The strong solvent characteristic of d-limonene makes it harm the binder in asphalt formulas, which is a good thing when the goal is simply cleaning the equipment,” Phillippi said.

For release agents, ChemStation offers different formulations, their most popular a sugar-derived natural soap that doesn’t strip asphalt binder while creating a barrier.

Other approaches include polymer chemistries pioneered in the textile industry as thread lubricants, cellulose derivatives to provide slip and barrier resistance without asphalt degradation, classic soap, and surfactant-based formulations for release.

Solvent Versus Release Agent

“Citrus is a great cleaner,” Murray said. In the first five minutes, she said, citrus may clean better, “but its evaporation rate would mean long-term, it is not as effective.” PavePro’s active ingredient has a slower evaporation rate than citrus, so it can stay on tools and equipment longer.

“We advise to apply it, wait between 5 and 30 minutes, or even overnight based on the amount of buildup, before cleaning,” Murray said.

Although PavePro has been marketed as a solvent, Murray said its use as a release agent is growing in popularity.

“[Many DOTs] think anything that could be used as a solvent could break down asphalt, so they assume a release agent [that doubles as a solvent] would hurt the integrity of the asphalt before it’s laid,” she said. They’ve worked hard to educate about their product.