Asphalt Industry Will Adapt to Steel and Aluminum Tariff Effects

BY Sandy Lender

By now, AsphaltPro magazine readers have probably heard the dire warnings from a handful of organizations concerning the additional duties the United States of America now imposes on steel and aluminum being imported from most foreign countries.

According to a release from the Secure Customs Brokers division of Clasquin Overseas Forwarding and Logistics, Valley Stream, New York, “all imports of steel articles specified in the Annex shall be subjected to an additional 25 percent ad valorem rate of duty with respect to goods entered, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time on March 23, 2018,” and “all imports of aluminum articles specified in the Annex shall be subject to an additional 10 percent ad valorem rate of duty with respect to goods entered, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time on March 23, 2018.

This rate of duty, which is in addition to any other duties, fees, exactions, and charges applicable to such imported aluminum articles, shall apply to imports of aluminum articles from all countries except Canada and Mexico.”

Capacity for Security

At first blush, that reads like a tax on building materials entering the United States. But there’s a deeper meaning behind the tariffs. The United States isn’t imposing taxes on foreign entities for the sole purpose of getting off-shore businesses to help pay off national debt. Here’s what the U.S. Department of Commerce (USDOC) had to say.

At first blush, that reads like a tax on building materials entering the United States. But there’s a deeper meaning behind the tariffs. The United States isn’t imposing taxes on foreign entities for the sole purpose of getting off-shore businesses to help pay off national debt. Here’s what the U.S. Department of Commerce (USDOC) had to say.

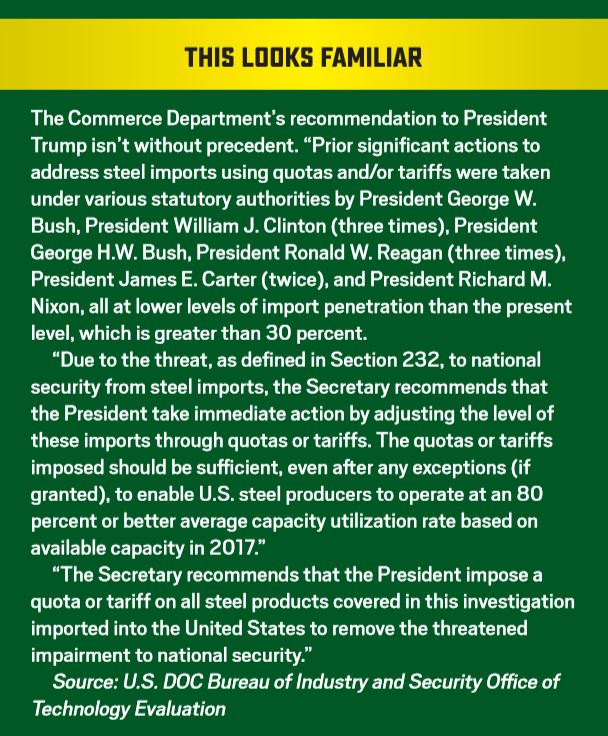

The USDOC Bureau of Industry and Security Office of Technology Evaluation sent a 262-page report to The President of the United States Jan. 11, 2018. I read the document, including appendices A through L.

The issue of whether or not the USA should support its steel manufacturing capabilities by assessing additional duties on imported steel and aluminum products goes beyond the discussion of pricing equipment from overseas versus pricing equipment from Florida, Iowa, Kentucky, Tennessee, etc. Imposing a tariff on steel from foreign countries was a recommendation of the USDOC for the purpose of future economic welfare and national security.

“The Secretary also recognized the close relation of economic welfare of the United States to its national security; the impact of foreign competition on the economic welfare of individual domestic industries; and any substantial unemployment, decrease in revenues of government, loss of skills, or any other serious effects resulting from the displacement of any domestic products by excessive imports, without excluding other factors, in determining whether a weakening of the U.S. economy by such imports may impair national security,” the USDOC document states.

In particular, this report assesses whether steel is being imported “in such quantities” and “under such circumstances” as to “threaten to impair the national security.”

The report found that “[i]mports in such quantities as are presently found adversely impact the economic welfare of the U.S. steel industry,” and “[i]mports are priced substantially lower than U.S. produced steel…Displacement of domestic steel by excessive quantities of imports has the serious effect of weakening our internal economy,” and “Global excess steel capacity is a circumstance that contributes to the weakening of the domestic economy.”

“Based on these findings, the Secretary of Commerce concludes that the present quantities and circumstance of steel imports are ‘weakening our internal economy’ and threaten to impair the national security as defined in Section 232.

The Secretary considered the Department’s narrower investigation of iron ore and semi-finished steel imports in 2001, which recommended no action be taken, and finds that several important factors—the broader scope of the investigation, the level of global excess capacity, the level of imports, the reduction in basic oxygen furnace facilities since 2001, and the potential impact of further plant closures on capacity needed in a national emergency, support recommending action under Section 232.

In light of this conclusion, the Secretary has determined that the only effective means of removing the threat of impairment is to reduce imports to a level that should, in combination with good management, enable U.S. steel mills to operate at 80 percent or more of their rated production capacity.”

When I read the March 2018 Global Steel Trade Monitor from the International Trade Administration, I learned that the top three steel producers in the United States owned by U.S. companies manufacture less than the 80 percent the Secretary recommends. “Based on available data, the top three domestically-owned producers accounted for 56 percent of total United States production in 2016,” the report stated.

One of those three domestically-owned producers supplies material to an original equipment manufacturer (OEM) that asphalt professionals will recognize: Roadtec Inc. in Chattanooga. Roadtec President John Irvine shared the reality taking place during the week of April 2 for his company.

“We are very fortunate in Chattanooga having the Nucor Steel Plant in Ft. Payne, Alabama, 40 miles from here. Our main supplier, Siskin Steel, and its partner (Nucor Corporation) are very in tune and responsive to our needs. Siskin delivers steel daily to Roadtec, Astec and Heatec here in Chattanooga. We buy about $25 to $30 million worth of steel from them annually. They keep us up to speed on developments in steel cost developments. This week we negotiated our third quarter steel buy. The cost of steel is going up 39 percent on all the a36 steel we buy. This is the majority of what we buy other than the specialty t-1 tool steel, chromium carbide liners, ni-hard cast augers, etc. Some say steel will go to 60 percent or 70 percent higher than what we are experiencing today by year-end when tariffs take hold. Availability is not a big concern, but availability at a good price is.”

What that means for asphalt professionals is potential price increases from OEMs by year-end. Irvine suggested contractors who are considering adding to their fleets go ahead and make the decision to do so, no matter who they’re buying from, before prices go up. He did the math, showing his work.

“Our product is approximately 7 percent flat steel and bar stock; this does not include the product we buy, which is made from steel. But we outsource very little fabrications, weldments or machining. If you apply a 39 percent increase to our product that is 7 percent steel, customers will see a 2.73 percent increase in the cost of our product in the third quarter 2018. If [the price of steel] goes to 80 percent increase by year-end, [customers] will see a 5.6 percent increase in cost over what they are buying for at today’s prices.”

Industries React

At another industry event in March, I visited with Mark Schreiber, an engineer and owner of Mi-Way Inc., Sarasota, Florida, who has cleared abandoned manufacturing facilities across the United States in his career. Schreiber shared that he has led teams in dismantling machinery and assembly line equipment from buildings that have been closed down. The materials then are shipped to foreign countries—he named China specifically—where they are melted down, refined into new steel stock, and then sold back to United States’ manufacturers at a price point that is lower than what U.S. steel refiners can compete with. But China isn’t the only country supplying steel to the United States.

In fact, despite being the largest supplier of steel in the world (according to USDOC), China barely edges into the top 10 importers of steel to the United States (according to stats in Global Steel Trade Monitor). The United States is the 26th top export source of steel for China (See Table 1). The “hope” of the steel (and aluminum) tariffs is to bring more of that production back onshore. It’ll take more than one company getting behind the idea, but it has started with one.

United States Steel Corporation (NYSE:X), headquartered in Pittsburgh, announced March 7 it would restart one of its blast furnaces at its Granite City, Illinois, location and needed about 500 employees to come on back to work. It posted ads for specific metallurgists, welders and others with “no experience needed” with wages ranging from $16 to $35 per hour. The corporation listed favorable market conditions, the ability to extend its own borrowing power until 2023, and the tariff proclamation, among the factors leading to getting production back in place.

When you get right down to it, materials expenses will rise in terms of fuel scrubbers on the large ships that bring foreign steel (more on that topic in the June issue). Materials expenses will rise in terms of decreased capacity within the United States if our steel industry doesn’t catch up to the rest of the world. Materials expenses will rise in the form of Beijing’s narrative of “construction explosion” ramping up to the next Olympics there. Materials expenses will rise in the form of inflation and the cost of doing business. Luckily, the asphalt industry is able to adapt to the ebb and flow of materials expenses.

Leonard Loesch, the CEO of Stansteel, Louisville, Kentucky, pointed this out with the example of liquid asphalt cement (AC) prices we lived through over the past 25 to 30 years.

Departments of transportation (DOTs) built escalators into the bidding/payment process to protect contractors from financial ruin. We all know how it works: if you bid a project in May when AC prices are $300 a ton, and then begin work in July when AC prices experience a jump to $500 a ton, the state pays a percentage to help absorb the difference. The contractor doesn’t have to hedge and guess and try to foretell weather or war events messing with refineries and AC capacity two months from his estimating date. This makes the asphalt industry flexible and adaptable like few other industries.

“The asphalt industry is one that has the most adaptability built into it because contractors take contracts when they don’t know what the cost of liquid AC will be in the future,” Loesch said. “Asphalt contractors will adapt to price changes in materials and equipment.”

Astec CEO Ben Brock offered similar words of wisdom. “Steel prices were already increasing several months before the tariffs were announced,” Brock said. “The tariffs will raise steel prices even more. Most contractors buy steel and understand the pricing is going up for the steel they buy, and that prices for products that contain steel will go up as well. We watch steel supply, demand and pricing on a consistent basis and make adjustments as necessary. Those adjustments always include working for cost reduction mechanisms in an effort to keep our prices in line. Contractors using steel in what they do are likely doing the same things we are doing, and bidding/pricing jobs appropriately as well.”

Loesch stated that with the steel tariff discussion there aren’t any solid knowns, but wise OEMs will include escalators in pricing, as will the contractor. “If the base price goes up, the end price goes up.”

Notice he said, “if.”

“American steel companies already know what their costs are,” Loesch said. “They already have their iron ore and sources of supply.” He reminded readers that American steel companies can continue doing business as usual and still make money, without having to raise prices.

“Playing games with numbers shouldn’t last more than a year or two when it comes to the steel companies,” he suggested. “Right now, the steel companies see an opportunity to raise their prices.”

He’s right. Ken Simonson is the chief economist for the Associated General Contractors of America (AGC), which reported that “[t]he producer price index for inputs to construction industries, goods—a measure of all materials used in construction projects including items consumed by contractors, such as diesel fuel—rose 0.8 percent in March alone and 5.8 percent over 12 months.”

What I found interesting in AGC’s analysis is a continuing focus on China.

“Prices increased for many items in March, even before tariffs announced for steel, aluminum and many items imported from China have taken effect,” he stated in an April 10 AGC press release. “Steel service centers and other suppliers are warning there is not enough capacity at U.S. mills or in the trucking industry to deliver orders on a timely basis. Thus, contractors are likely to experience still higher prices as well as delivery delays in coming months….today’s report only reflects prices charged as of mid-March. Since then, some tariffs have taken effect, many others have been proposed, and producers of steel and concrete have implemented or announced substantial additional increases.”

Personally, I won’t lose sleep if rebar suddenly doubles in price making bids on concrete projects go up. But the fact of the matter is the cost of rebar is probably not going to double, and concrete pavers will likely adapt with escalators in their bidding processes. Contractors on both sides of the paving aisle (asphalt and the gray matter) know how to adapt to materials expense changes.

One global OEM has reacted to potential steel price hikes without changing base prices. Terex Corp. CEO John Garrison penned a letter to customers March 6 saying: “Steel prices have been rising steadily for several months and this action [tariff proclamation] drove prices even higher, reaching heights not seen in many years. The longer-term impact of the trade action is uncertain, but the inflationary impact on steel prices and related components is already increasing our product cost.

“Unfortunately, the impact of the rising cost of steel is too large and too sudden for us to absorb,” Garrison’s note continued. Rather than increase base prices, Terex will add on a steel cost surcharge. “The surcharge will cover a portion of our cost increases—and will remain separate and transparent from base prices. As the price of steel normalizes, we will adjust or remove the surcharge.”

Other global companies are taking a wait-and-see approach, not willing to pass taxes down to customers yet. During the Wirtgen Technology Days event in Nashville March 29, Domenic G. Ruccolo, CEO of Wirtgen Group Branch of John Deere, participated in a morning press conference. Ruccolo shared with us that the Wirtgen Group families—Deere, Hamm, Kleemann, Vogele, Wirtgen—will adapt to the changes as things move along. “As regulations change, we’re going to adapt as a global company,” he said.

This is advice OEMs were willing to offer asphalt professionals. Adapt as the industry always does. But adapt while watching how tariffs truly affect real prices in the real world over the next few quarters, and while watching the U.S. steel industry return to 80 percent—or higher—capacity as the USDOC Secretary recommends.