How to Drive Profits at the Asphalt Plant

BY Sean Rizer

Understanding the numbers behind the asphalt plant takes proper effort to maximize the return on investment (ROI). We will explore some financial challenges the plant presents, and how to manage your business around those challenges to help drive profits.

In evaluating the financial position of a plant, there are three primary drivers to consider when determining its return on investment: fixed costs, variable costs and sale price of mix. It is critical to understand how these three drivers interact together. However, every plant is different in its management and operating style so the impact these drivers have on your plant must be examined and applied to your specific situation.

Fixed costs

Fixed costs are those that are incurred regardless of how many tons are run through the plant in a given time period (hourly/daily/weekly/monthly/annual). The cost per ton produced will vary depending on how many tons are run through the plant. These costs would commonly include salaries and benefits for plant managers, property and casualty insurance, depreciation, property taxes, and administrative overhead allocations.

Variable costs

Variable costs are those that are incurred primarily when the plant is running and the cost per ton produced does not vary depending on how many tons are run through the plant. However, the total dollars expended do vary based upon the number of tons run through the plant. Variable costs commonly include liquid asphalt, aggregates, hourly labor and benefits, repairs and maintenance, plant gas or electricity, and plant fuel. The variable costs such as liquid asphalt and aggregates also vary depending on the composition of the asphalt blend.

Sale price

Sale price is the market price charged for each transaction when asphalt is sold by the plant. This price varies depending on the asphalt blend and does not include transportation to the job site.

To begin understanding the relationship these three drivers have with each other, it is common to begin with a break-even analysis. To quantify the break-even point a plant has, the following formula is used:

Break Even Tons = Fixed Costs / (Sale Price per Ton – Variable Costs per Ton)

The next step beyond break-even is determining a targeted ROI the plant expects to generate. When dealing with a high volume of transactions, understanding both fixed and variable costs down to the penny per transaction can make a significant difference at the end of a season.

The sale price is often market driven so it is critical to know what the local market will bear in terms of sale price per ton. Forecasting these drivers with precision will determine whether budgeted net profit is reasonable given the local market and fixed and variable cost structure.

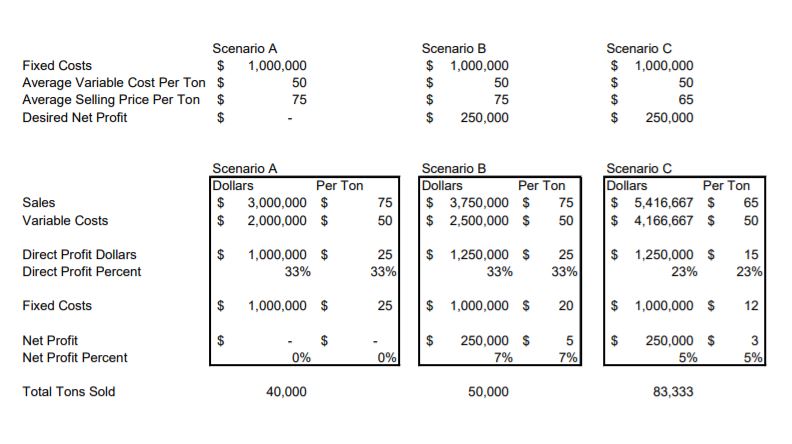

The following are a few example scenarios of how this analysis is performed and you can see them displayed in the table on this page.

Scenario A: The plant has fixed costs of $1,000,000, an average variable cost of $50 per ton and an average sale price of $75 per ton. To return no net profit, the plant needs to make 40,000 tons.

Scenario B: The plant has fixed costs of $1,000,000, an average variable cost of $50 per ton and an average sale price of $75 per ton. To return $250,000 net profit, the plant needs to make 50,000 tons.

Scenario C: The plant has fixed costs of $1,000,000, an average variable cost of $50 per ton and an average sale price of $65 per ton. To return $250,000 profit, the plant needs to make 83,333 tons.

The relationship between the three scenarios in how the dollars or per-ton amounts vary are critical to understanding what the right model is for building the projected throughput for the plant. This analysis is most beneficial as an ongoing tool by tracking and evaluating the accuracy of the forecasting and updating the modeling for updated market conditions.

For instance, if liquid asphalt—a variable cost—has a significant change, does that drive a change in sale price? If a new full-time salaried employee—a fixed cost—is added to the plant, how does that change the throughput required to cover that additional cost?

The next step is to take the analysis to a per-product level. Plants produce several blends of asphalt and those variable costs and sale prices have enough fluctuation in them depending on the product type—base, intermediate, surface, agency spec and so on. Because of this, it is important to understand your projected tonnage throughput in the plant by product type. This will help you know and understand where the direct profit dollars and percentages need to be by product line in order to cover the fixed cost and profit motive of the plant.

The plant manager must also consider what the realistic tonnage throughput is. In the above three scenarios, is the plant capable of producing 40,000 to 83,000 tons during the expected time period? If those are not realistic tonnage outputs, then a revision to the analysis is needed to determine how to run the expected tonnage while still achieving the desired net profit.

Sean Rizer is the CFO for Harding Group, Indianapolis, Indiana, which performs asphalt services, supplies hot mix asphalt and provides dump truck transportation. Prior to joining Harding Group, Rizer spent over 10 years in public accounting, providing operational and transactional consulting. He graduated from Valparaiso University with a bachelor’s degree in both accounting and finance.

Sean Rizer is the CFO for Harding Group, Indianapolis, Indiana, which performs asphalt services, supplies hot mix asphalt and provides dump truck transportation. Prior to joining Harding Group, Rizer spent over 10 years in public accounting, providing operational and transactional consulting. He graduated from Valparaiso University with a bachelor’s degree in both accounting and finance.